Several months ago I did some work on a trial basis for AI Impacts. It went well enough, but the process of agreeing in advance on what work needs to be done felt cumbersome. It's not uncommon that midway through a project, it turns out that it makes sense to do a different thing than what you'd originally envisioned - and because I was doing this for someone else, I had to check in at each such point. This didn't just slow down the process, but made the whole thing less motivating for me.

Later, I did my own research project. When natural pivot points came up, this didn't trigger a formal check-in - I just continued to do the thing that made the most sense. I think that I did better work this way, and steered more quickly towards the highest-value aspect of my research. Part of this is because, since I wasn't accountable to anyone else for the work, I could follow my own inner sense of what needed to be done.

I was talking with Katja about my work, and she mentioned that AI Impacts might potentially be interested in funding some of this work. I explained the motivation problem mentioned in the prior paragraphs, and wondered out loud whether AI Impacts might be interested in funding projects retrospectively, after I'd already completed them. Katja responded that in principle this sounded like a much better deal than funding projects prospectively, in large part because it would take less management effort on her part. This also felt like a much better deal to me than being funded prospectively, again because I wouldn't have to worry so much about checking in and fulfilling promises.

I've talked with friends about this consideration, and a few mentioned the fact that sometimes people are hired as researchers with a fairly vague or flexible research mandate, or prefunded to do more like their prior work, in the hope that they'll produce similarly valuable work in the future. But making promises like that, even if very abstract, also makes it difficult for me to proceed in a spirit of play, discovery, and curiosity, which is how I do some of my best work.

It also offends my sense of integrity to accept money for the promise to do one thing, or even one class of thing, when my real plan is to adopt a flexible stance - my best judgment might tell me to radically change course, and at this stage I fully intend to listen to it. For instance, I might decide that I should switch from research to writing and advocacy (what I'm doing now). I might even learn something that persuades me to make a bigger commitment to another course of action, starting or join some organization with a better-defined role.}

What doesn't offend my sense of integrity is to accept money explicitly for past work, with no promises about the future.

Then it clicked - this is the logic behind impact certificates.

In 2015, Paul Christiano and Katja Grace decided to explore funding beneficial projects retrospectively instead of prospectively. The basic idea is that instead of seeking funding at the beginning of a project, you do it on spec, and then afterwards, sell it for the value* of the impact it had on the world. The funder, instead of donating to a project in advance, buys an "impact certificate" afterwards, and thus acquires part or all of the moral responsibility for the net benefits produced by the project.

Robin Hanson proposed funding projects after the fact back in 2011, via a prize mechanism:

Consider a donor who seeks to encourage or induce some sort of result in the world. With a grant, such a donor must decide ahead of time who seems to have a promising ability and approach. But with a prize, a donor need only decide after the fact who seems to have achieved a lot. Once potential awardees see a pattern of achievements being rewarded by prizes after the fact, they will gain an added incentive to achieve, an incentive roughly proportional to the prize amounts being offered. And the prize process avoids much of the added waste of grant proposals, review, search, etc. (Promising potential winners who are strapped for cash might obtain resources by selling their future prize rights in capital markets.)

Since it is much easier to evaluate what has worked than what will work, folks who read a lot of intellectual work and who are inclined to support future intellectual work via charity should consider making a habit of just giving money to those who have already accomplished something noteworthy. Most intellectuals have some resources at their disposal and look for promising future directions on which to spend such resources. Your awards for previous achievements should increase the incentive to all intellectuals to achieve similarly praiseworthy results in the future. This will better target your goals because you can better judge what past work has promoted your goals than which future people and approaches might do so.

The theoretical benefits of a market in impact certificates, or published prizes, are clear. People with a great idea that's hard to explain could just do it, and seek funding afterwards. People who find projects or the team working on them hard to evaluate in advance, could fund after they've seen results. People with greater ability to predict a project's success would be able to make money prefunding projects, then selling impact certificates once the project is complete.

But when I first tried to think about impact certificates, I ended up confused as to why anyone would want to buy or sell them, in large part because of the framing. In the original setup, the price of an impact certificate should be the minimum amount of money the seller would accept to undo the impact of the project. The buyer is buying the whole moral credit for the project. This seemed to me like it was definitionally a break-even proposition if I accepted it in good faith - I get some money, but lose an amount of moral credit I value equally. In general, one should be interested in selling things for a profit, but not in selling things for exactly the value one gets for holding onto them. Why would I want to bother undoing the impact of a project for exactly enough money to offset the loss of its benefits?

Another problem is the establishment of a credible evaluator. The work of comparing the effect of mass distributions of long-lasting insecticide-treated bed nets vs lobbying for policies that help people in the developing world vs doing research to prevent the emergence of a superintelligence with values that catastrophically diverge from human values, as well as how effective more speculative research projects have been. The whole thing seemed like a mess, given that organizations like the Open Philanthropy Project already seem capacity bottlenecked.

But the analogy to AI Impacts postfunding instead of prefunding my work makes much more intuitive sense to me. When one person funds a project, and another one accepts the funding and does the work, it's generally felt that some of the credit for the project goes to the worker, and some to the funder. Generally the funder can't buy part of the worker's credit by paying more - these are somehow non-fungible. (On the other hand, people working "for a good cause" often accept a lower salary, presumably compensated by receiving the worker's moral credit.)

If I'd be happy to accept funding for a project in advance, then, having done it on spec, I ought to be happy to accept funding after the fact. (And as my interaction with Katja shows, there are also cases where I might be reluctant to accept prefunding, but happy to accept postfunding.) The moral credit the buyer receives is the same as the moral credit a funder would receive by prefunding the project.

Of course, the funder's credit can only be allocated once. Tricks like matching donations don't actually expand the share of credit a funder gets relative to the share of funding they provided, and neither does this. If someone's prefunded a project, then the person who did the work can't sell an impact certificate - it's already been sold, in principle, to the prefunder. Someone seeking to fund retrospectively would have to buy the certificate off of the prefunder.

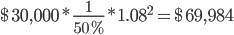

The natural price for an impact certificate is the amount the funder would have been willing to donate, in advance, to fund the project, adjusted for the time value of money and the prior uncertainty that the project would succeed. For instance, suppose I spend a year on a research project that ends up furthering some important goal such as AI research. If someone would have been willing to pay me $30,000 in advance to spend a year on a research project, and they think the expected value of such a project is 50% of what I actually produced, and they're buying the impact certificate a year after the end of the project rather than at the beginning, and we discount at 8% per year, then the fair value of the whole impact certificate is  .

.

My framing has some substantial disadvantages: It relies on opaque intuitions about assigning moral credit. It relies on "common sense" estimates of how much a project should be funded for, instead of a market-like mechanism. On the other hand, buying the "funder's share" of the credit can be implemented immediately, on an ad hoc basis, without waiting for a liquid market, using already existing intuitions about how much it's fair to pay and how much credit the funder should get.

I am trying to describe the minimum viable product that serves the need impact certificates and prizes are aimed at. If you're a funder and want to support more work in a field, a fast way to do it is to simply find a small unfunded finished project that you think was valuable, and offer to fund it. If you don't know of any work in the field that you'd be interested in funding, I encourage you to describe the sort of thing you are willing in principle to fund, and how much you might be willing to pay for it, either in the comments here or elsewhere. If you'd rather not do it publicly with your name attached, you can comment anonymously. Or email me directly and I'll see if I can find people who are doing that sort of project for you.

(I hope everyone understands that a funder who does this is not offering a guarantee or prize unless they explicitly say so. Nor are they under any obligation to evaluate everyone who talks about their project. I'm trying to describe the simplest action that can possibly improve things in this direction, not a fair overall system for allocating capital.)

If you've done unfunded work and would like to do more but need funding, the obvious next thing to do is simply talk about your work, and indicate that it is unfunded and that you would be willing to sell the funder's credit. For my part, I don't have a list of prices yet, but I've done some projects unfunded (as of this post), for no other reason than that I thought they needed to be done. Here are a few of them:

- I built a conceptual framework for AI takeoff scenarios.

- I put together a proof of concept of what it would look like to take such a framework and mathematize it. (Eliezer recently pointed out to me that he laid out the case for this in intelligence explosion microeconomics. These are exactly the reasons I decided to try this, and I was probably unconsciously influenced by a skim of that paper a few years ago.)

- I've blogged about human psychology and cooperation, cognitive skills, and effective altruism.

- I jump-started the DC EA meetup in mid-2014 and organized a pilot project (with crucial technical assistance from Richard Bruns and participation from other DC and UMD EAs) that eventually turned into Effective Altruism Policy Analytics under the leadership of Matt Gentzel (now in the San Francisco Bay Area working on other projects).

Personally, I'm fine having done these for free, but I'd happily sell the funder's credit, and if one particular project (or blog post) were funded, it would be a credible signal to me that someone else thought that kind of work was valuable, making me somewhat more motivated to take on similar projects in the future. In the long run, this also enables me to spend more time on the best projects I can think of without worrying about whether I'm going to run out of cash, and I think lots of people with less of a runway than I have are much closer to that margin.

If I were making more money than I'm spending on myself, I'd want to fund more projects that I think are good - so I'd not just be a seller of impact, but a buyer as well, whether in the form of certificates or some other way.

I encourage anyone else who's completed an unfunded projects and would be open to selling the funder's portion of the moral credit, to mention their project in the comments and link to their work. Howie has elsewhere suggested that a list of projects people failed at fundraising for would also be helpful. I'm not sure anything will come of this, but it seems worth a try.

One more way to help, since this is a largely unexplored area, would be for someone who knows the relevant tax law to write up the likely tax implications, especially in the US.

* The exact pitch to sellers on the impact certificates website is:

- You tell us about something good you did.

- We offer you some money.

- You decide whether the money would be enough to justify undoing the impact of your project. If so, you take it. (The impact of your project isn’t actually undone!)

- In attributions, you mention that you’ve sold part of the impact in order to finance the project.

"he laid out the care for this" probably should be "he laid out the case for this"

Thanks! Fixed.

Pingback: GiveWell: a case study in effective altruism, part 1 | Compass Rose

Pingback: GiveWell and partial funding | Compass Rose

Pingback: MeToo is good | Compass Rose